The Financial Intelligence Agency of Liberia (FIA) has admonished insurance companies operating in Liberia to adhere to the country’s lawful AML/CFT requirements that mandate all reporting entities to update their respective Anti-money laundering, Countering the Financing of Terrorism and Proliferation Financing (AML/CFT/PF) regime policies and continuously conduct risk-based assessment for pre-existing and new customers, new products, services and delivery channels, to mitigate and combat money laundering and other financial crimes.

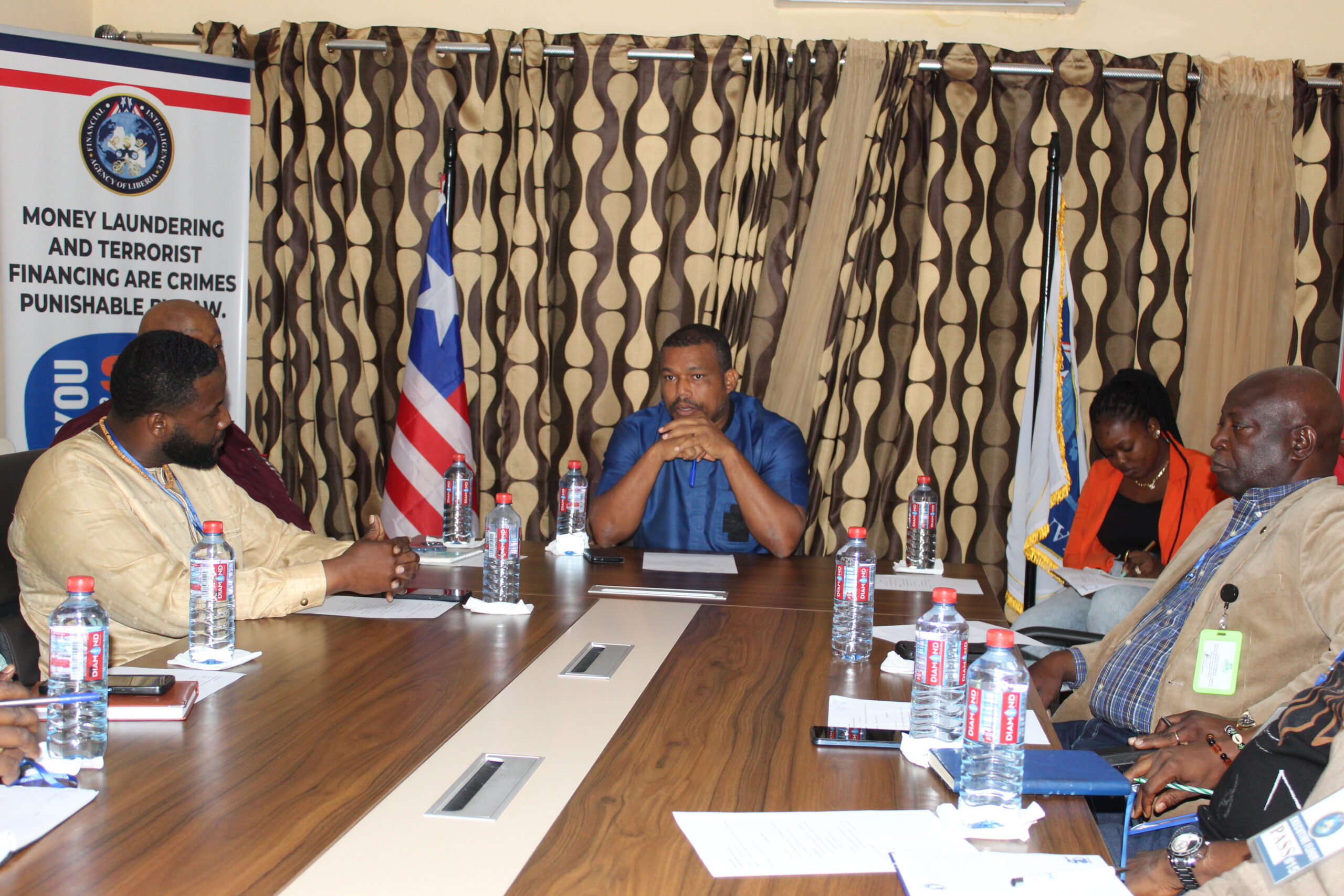

Recently interacting with Chief Executive Officers (CEOs) of Insurance Companies in Liberia, FIA Officer-In-Charge, Mohammed A. Nasser, said section 67.3 of the FIA Act of 2021 authorizes the FIA to issue regulations, circulars, guidelines, and formats, among other directives, for the lawful

regulation of the insurance, banking, gaming, fintech, and other AML/CFT sectors that need appropriate preventive measures to curb and fight money laundering and other illicit financial activities.

The OIC reminded sector stakeholders that section 15.3.10 of the FIA Act of 2021 gives insurance companies and other reporting entities a mandate to identify, assess, and take appropriate measures to manage and mitigate potential money laundering and terrorist financing risks that may arise from introduction/rolling out of new products, technology, and non-face-to-face

business transactions.

He urged insurance companies and other reporting entities to update their AML/CFT policies and assess their risk-based control frameworks to help improve professional record-keeping at their respective entities for effective upkeep of accurate information documented and kept for future reference.

Mr. Nasser stressed that control factors and overlapping risks between AML/CFT and prudential risks – such as credit, market, operational, reputational, and legal risks – shall be properly assessed by insurance companies and other reporting entities to achieve customer due diligence (simplified due diligence and enhanced due diligence) and deepening public awareness about AML/CFT to improve collaborative support to tackle money laundering and other associated

predicate offenses.

“Insurance companies and other regulated entities need to obey Liberia’s AML/CFT laws by routinely developing risk-based profiles of their clients, frequently monitoring and sanitizing their delivery channels; where their products and services are patronized. They need to conduct customer constantly due diligence for life insurance and other services to aid the global call for the fight against money laundering and other financial crimes that are posing serious threats to Liberia’s financial system”, OIC-Nasser emphasized.

The FIA Officer-In-Charge accentuated that periodic due diligence of customers should be conducted by insurance companies and other reporting entities to aid them in meeting enshrined AML/CFT legal requirements when the FIA is conducting onsite inspections at their facilities and also reviewing their records face-to-face in line with internationally accepted AML/CFT standards and regulations.

Also speaking in separate remarks, Chief Executive Officers (CEOs) of participating insurance companies who attended the interactive meeting, promised to collaborate and cooperate with the FIA in adherence to Liberia’s AML/CFT laws to support the fight against money laundering and other related predicate offenses.